| Top 5 Views |

| Minimum Alternate Tax and its recent impact o... |

| Popular and Unique Stocks |

| Start early to meet your financial goals |

| Decoding the concept: Value at Risk |

| Direct Plans – An Overview |

In sharp contrast to global equity markets, investments in gold finished the financial year 2014-15 in a decline. The metal declined 7.8%, accentuating the fact that the rally witnessed in the precious metals during 2008-2012 period is almost over.

Gold, being a commodity, is a non-productive asset; it doesn’t have cash flows of its own to derive an intrinsic value. Its pricing is based on the demand-supply situation in the markets. The fear of incurring losses and limiting them was a key driver for investors moving to this asset class.

Investors resorting to gold as an investment option after the 2008 global financial crisis were a common phenomenon. Gold prices rose in 2009, gaining about 24% by year end. The stage was set for gold’s rally in 2009 – and for the next few years – when the global financial crisis was entering into prolonged period of uncertainty. The safe-haven appeal of the metal played on investor psyche. Safe havens are sought after by investors to limit their exposure to losses in the event of market downturns.

How did the gold ETFs fare after the financial crisis?

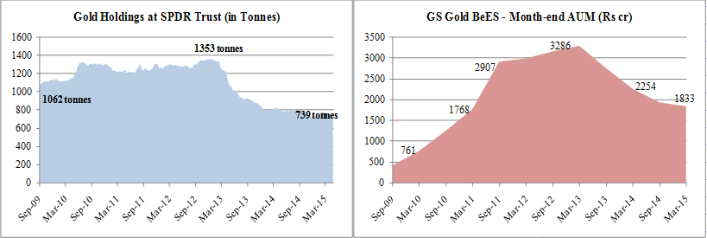

SPDR Gold Trust (one of world’s largest Gold ETF that trades on NYSE) saw inflows rise during 2009-2012 period, with holdings touching a high of 1353 tonnes in Dec’12. However, since 2013, with correction seen in international gold prices, the holding at SPDR has shrunk by 45% to stand at 739 tonnes on 30th Apr ‘15.

Source: MFI Explorer, http://www.spdrgoldshares.com

On the domestic front we see a similar trend. Goldman Sachs Gold BeES one of India’s oldest and largest ETF saw a swift increase in corpus from Sep 2009 that touched an all-time high of Rs 3286 crore in Mar ‘13 before seeing a gentle slide down. As on Mar ‘15, the AUM for GS Gold BeES had shrunk 44% from its peak levels.

Global economy – post crisis and way ahead

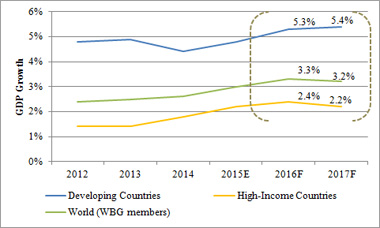

As per the World Bank’s report*, the global economy is still struggling to gain momentum as many high-income countries continue to grapple with the legacies of the global financial crisis. The recovery in high-income economies has been uneven, as some (the United States and the United Kingdom) have managed to surpass pre-crisis output peaks, but others (the Euro Area) are still below earlier peaks. Middle-income economies have also been less dynamic than in the past not only for cyclical reasons but also due to a structural slowdown. However, low-income countries continue to grow at a robust pace despite a challenging global environment. Overall, global growth is expected to rise in 2015 to 3.0 percent and be sustained at 3.2-3.3 percent in 2016-17*.

Source: www.worldbank.org

Investors holding on to gold assets are now wondering if their losses will get worse. To address this issue we have tried to highlight the fundamental changes in global economy which bears significant impact on Gold’s performance as an asset class.

- Gold is considered a hedge against inflation, but inflation in India looks stable currently, and other assets such as equities (both in developed and emerging markets), have provided better returns.

- Gold being a commodity, its price is subject to changes in demand and supply in global markets. As per the World Gold Council (WGC) report, demand for gold dipped in both India and China in 2014 from record levels a year earlier. Indian demand slid 14 percent, compared with a much steeper 38 percent fall in China. The two countries accounted for over half of global demand in 2014.

- Improvement in key economies worldwide – If the leading economies continue to recover (as per World Bank forecasts), gold is expected to lose its safe-haven appeal as panic and fear has been the major trigger for investors favoring gold over other assets classes.

- Better than expected recovery in the US will make US dollar more attractive for various central banks to hold compared to gold.

- Surplus liquidity in global markets is expected to come down as US Fed has started to wind down its bond-buying program. Less liquidity means more selective buying by investors.

Conclusion

Long term investment into commodities is a high-risk decision compared to other asset classes which offer periodic returns/benefits to shareholders in the form of coupon (interest payments), dividends, share buybacks or bonus apart from price appreciation. However the diversification aspect of investing in commodity holds true. We recommend that investors seek expert opinion before venturing into long term commitments.

*Reference: http://www.worldbank.org/en/publication/global-economic-prospects/data

To contact the author: amol.wakekar@icraonline.com