| Top 5 Views |

| Minimum Alternate Tax and its recent impact o... |

| Popular and Unique Stocks |

| Start early to meet your financial goals |

| Decoding the concept: Value at Risk |

| Direct Plans – An Overview |

As a retail investor my focus has often been on equity funds. These are the ones that you hear about often; they give great returns and frankly, who doesn’t like to see their money grow? It also is convenient that they are easy to buy and sell, have low transaction costs and the ability to identify stocks with their corresponding companies gives an overall comfort feel to this asset class. The only drawback is they come at a higher risk. We know this and accept it.

However as financial experts recommend, it makes ample sense to invest in other asset classes for diversification. Other asset classes would include any asset that gets value from a different instrument. So for an equity investor, diversification would include assets like Real Estate, Debt, Currency, etc.

Why is diversification recommended?

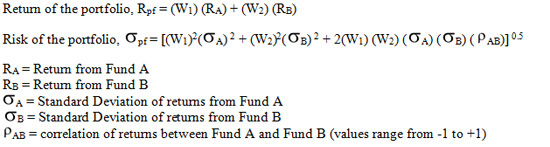

In a portfolio of multiple assets, the return of the portfolio is the weighted average return of all the assets comprising the portfolio and the risk of the portfolio is derived from the risk of individual assets in the portfolio.

Consider a portfolio that has invested in two mutual fund categories – Fund A and Fund B; the weight of investment in each fund is W1 and W2 such that W1 + W2 = 100%

The last variable, AB, is a critical one. It helps in reducing the overall risk of the portfolio under certain criteria. If the correlation of returns between two funds is zero or negative, then the variance (square root of standard deviation which is the measure of risk) of the portfolio is less than the weighted average variances of individual funds. The correlation of two funds can be zero or negative only when the instruments they invest in are of a different nature. A classic example would be the correlation between debt funds and equity funds.

Do Mutual Funds offer scope for Diversification?

The case for mutual funds in India offering diversification would be proven if the correlation of returns between funds from two different categories is zero of negatively correlated. Investment in two such funds would imply a risk of the portfolio that is less than the sum of the risks of the individual funds.

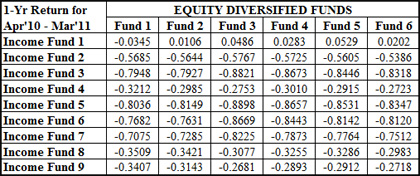

We did a random selection of a few equity diversified funds and a few debt income funds and ran a correlation between the 1-year rolling returns of the two funds.

Source: ICRA Online research

As we had expected we found very low positive correlation (in few cases) and medium to strongly negative correlation between income funds and equity diversified funds. We have refrained from calling out the names of these funds since these are random sample.

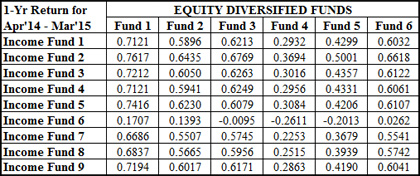

However when we ran the correlation between same set of funds for 1 year returns between Apr’14 and Mar’15, we found, on an average, medium to high positive correlation thereby leading one to conclude that when markets are on a rising trend, almost all funds tend to do well.

Source: ICRA Online research

A longer time frame of study would be required to develop some solid recommendations but, as explained in the article, one can’t really go wrong with diversification and thereby reducing the overall risk of investments.

To contact the author: poulomi.harolikar@icraonline.com